Usually, tax planning blogs come in the spring each year, before the 5th April, tax year end. But this year we’re writing a few weeks into the tax year, to ensure you’re as up to date as possible for the year ahead.

We’re covering lots of areas that won’t be new to regular readers, but some allowances have been adjusted.

Something we wanted to highlight this year is, for those of you working at home (you’ve been asked to by your employer following the pandemic) you can now claim Working from Home Tax Allowance.

We’ve also covered Gift Aid, as we get lots of questions about this throughout the year.

Investment allowances

A new tax year means new Individual Savings Accounts (ISAs, including JISA, LISA) allowances are now available and full pension year allowances too. Make sure you use these to maximise your tax free savings!

You can refer to our pre tax year end blog (HERE) to remind yourself of these.

None of these allowances have changed for the new 2022/23 tax year.

Income Tax allowances

For the tax year 2022/23 there are a few changes to bear in mind.

Your tax-free Personal Allowance

The standard Personal Allowance is now £12,570, which is the amount of income you do not have to pay tax on. Your Personal Allowance may be bigger if you claim Marriage Allowance or Blind Person’s Allowance. It’s smaller if your income is over £100,000.

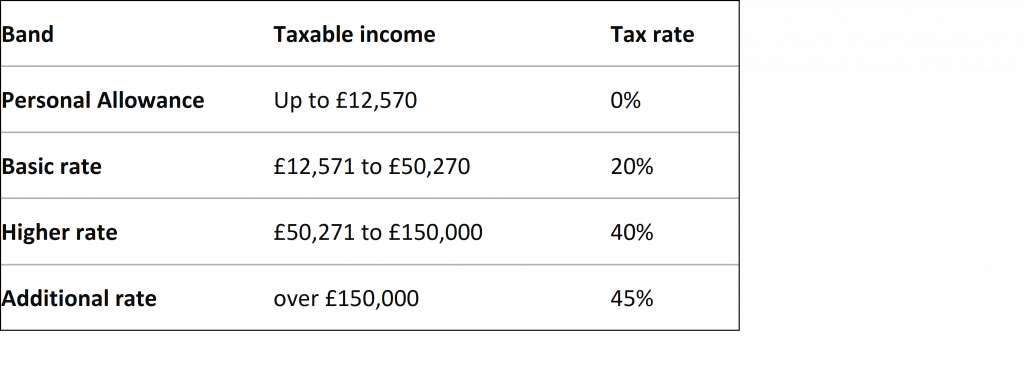

Income Tax rates and bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570. Income tax bands are different if you live in Scotland.

Other income tax allowances

You have tax-free allowances for:

- Personal Savings Allowance of £1,000 (reducing to £500 for higher rate tax payers;

- Dividend allowance of £2,000 before which you have to pay tax on dividends received

You pay tax on any interest, dividends or income over your allowances.

If you’re married or in a civil partnership and one of you earns less than the Personal Allowance £12,570 you may be able to claim Marriage Allowance to reduce your partner’s tax if your income is less than the standard Personal Allowance.

Captial Gains Tax Allowance

You only have to pay Capital Gains Tax on your overall gains (from investments or property) above your tax-free allowance (called the Annual Exempt Amount).

The Capital Gains tax-free allowance is:

- £12,300

- £6,150 for trusts

Working from home tax relief (for the employed)

You can claim tax relief if your employer has asked you to work from home. You won’t be able to claim this if your decision to work from home was voluntary.

You can claim up to £6 per week and you will receive tax relief of £1.20 per week (20% of £6).

You can read more HERE.

Understanding Gift Aid

Donating through Gift Aid means charities and community amateur sports clubs (CASCs) can claim an extra 25p for every £1 you give, and it doesn’t cost you any extra.

You need to make a Gift Aid declaration for the charity to claim. You usually do this by filling in a form – contact the charity if you have not got one.

If you pay tax above the basic rate, you can claim the difference between the rate you pay and basic rate on your donation. Do this either:

- through your Self Assessment tax return

- by asking HM Revenue and Customs (HMRC) to amend your tax code

Example: You donate £100 to charity – they claim Gift Aid to make your donation £125. You pay 40% tax so you can personally claim back £25.00 (£125 x 20%).

IMPORTANT NOTE ABOUT GIFT AID:

Your donations will qualify as long as they’re not more than 4 times what you have paid in tax in that tax year (6 April to 5 April). The tax could have been paid on income or capital gains.

You must tell the charities you support if you stop paying enough tax.

We hope this is of use for a quick guide and summary. If you would like to talk about any of these allowances and exemptions in more detail, please contact us and we will be happy to help.