Changes to Income Tax in Wales

With effect from 6 April 2019 income tax is changing in Wales.

Under the devolution of Welsh tax rates, the current basic, higher and additional rate tax bands will be reduced by 10% and replaced with a rate to be decided by the Welsh Government. The new rates will be payable by Welsh taxpayers and apply to non-savings income, including employment, self-employment, pension and rental income.

HMRC will be responsible for determining who is a Welsh taxpayer – based on a person’s address – so make sure your personal tax details are correct ahead of the changes.

So how does this work in practice?

From 6th April 2019, some of the income tax paid by people living in Wales will directly fund public services in Wales and will be transferred straight to the Welsh Government.

Primarily, this is a change from the current system, where all income tax from Wales is paid to the UK government to fund spending across the UK. The changes will enable the Welsh National Assembly to set income tax rates on non-savings and non-dividend income for Welsh taxpayers.

Ultimately, this means people in Wales could end up with different tax rates to those charged in England. Scotland already has a devolved tax system.

The Welsh Government proposes to set the first Welsh rates of income tax at 10% – so they should remain the same as the current level.

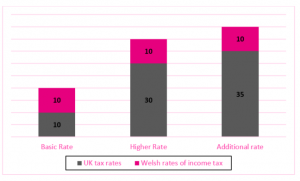

The following is an illustration to show the proportion of Welsh residents’ income tax that will be paid towards the Welsh government (based on 2018-19 tax rates).

What is the same?

Reliefs and allowances, such as Personal Allowance, stays the same as the rest of the UK. You’ll continue to pay the same tax as the rest of the UK on dividends and savings interest.

HMRC continue to be responsible for the collection and management of Welsh income tax, and as such it is not a fully devolved tax and remains part of the existing UK income tax system.

So, what does this mean for me if I live in Wales?

You do not have to do anything. HMRC will continue to collect your Income Tax as usual. However, you may notice a change in your tax code. From 6 April 2019, tax codes will start with a ‘C’ for Welsh taxpayers. Or you may notice a change to your self-assessment tax return, which informs HMRC that the Welsh rate applies to you.

Magenta is not a taxation or legal expert and this information is based on the understanding of the Wales Act 2014 and the Wales Act 2017 and guidance provided on the www.gov.wales website.