Worrying research lately has lead us to consider why is it that women are still so ill-informed and unconfident when it comes to money?

Many will of course say that is a sweeping generalisation. It’s true…. some women are in complete control, some are the main breadwinner of the family, some fully understand their money and are indeed more sensible and better informed than their male partners, however, the statistics we have read recently are worrying and tell another story:

- Research by Alliance Trust Savings this month has found that for women under 34, saving for a holiday is more important than saving for retirement!

- Research by Boring Money shows that women in their 40’s and 50’s lack confidence when dealing with their finances despite the importance of planning for their future. Of the 8.8 million women between 40-59 only 10% have an Investment ISA.

- Only 16% of women of all ages have savings and investment products compared to 24% of men.

- The survey also found that across all ages, women are significantly more risk averse than men around investing.

Our experience is that women gain a great deal of confidence when they talk with someone they feel will work with them to explain the necessary details without being patronising or using jargon.

Unfortunately, many women leave “the finances” to their menfolk who are often over optimistic, disorganised or ill-informed. This can lead to poor financial outcomes, particularly in the event of a relationship breakdown, where inexperienced women can feel very exposed and vulnerable.

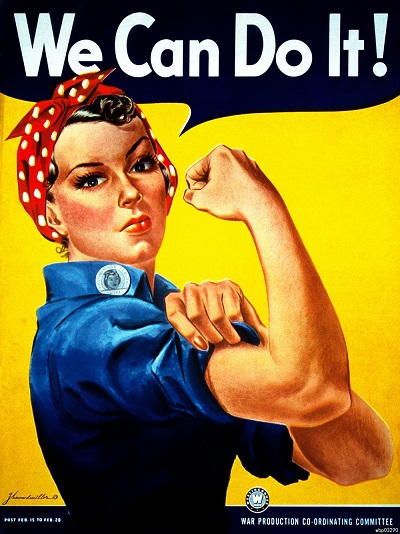

This is our “Oh Come ON Ladies” shout out to say that it is possible to understand and enjoy looking after your finances and that taking control can be empowering – enabling you to be happy and lead your life without worry.

Feel free to call us for a friendly chat if any of this resonates with you.

*As a footnote, we’d like to add that prioritising holidays over your retirement is a really daft!