Cashflow modelling is used by good financial planners to provide a picture of your financial and lifestyle future. It shows you how much money you could have in the future and whether you are on track to achieve your goals – helping to answer questions such as ‘do I have enough money?’ ‘when can I afford to retire?’ and ‘how much do I need to sell my business for?’

How does it work?

At Magenta, we don’t give any financial advice without first building a client model to show the current and future client situations, as to do so is simply guesswork.

The first step is to collect information about your monthly income and outgoings, savings and other assets, both now and what you can expect in the future. We will analyse this information together with your future goals and requirements, taking into account life events such as your retirement, one-off expenses like gifts to children, and even your death.

We will then crunch the numbers to create a long-term projection of your finances which we will use to determine whether or not you can achieve your desired lifestyle and identify any potential surplus or shortfall.

What is cashflow modelling used for?

Cashflow modelling helps people with all kinds of different goals to find out what their finances could look like and whether they will have enough money in the future. It can help to answer questions such as:

- Will I have enough money to stop working when I want to?

- Am I going to run out of money in later life or can I spend more now?

- Will my family be financially secure if I go into care or die unexpectedly?

- Am I going to leave behind an Inheritance Tax bill?

- Can I afford to give away money in my lifetime?

- How can my other savings, such as ISAs, contribute to my overall retirement income?

- How can I take an income in the most tax-efficient way possible?

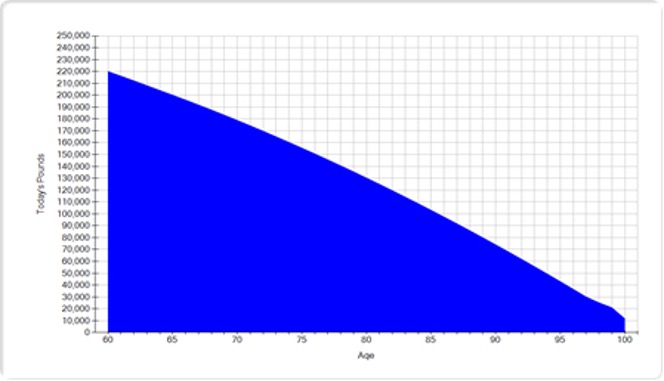

- Typical cashflow results: Spending too much; not enough income; money not working hard enough.

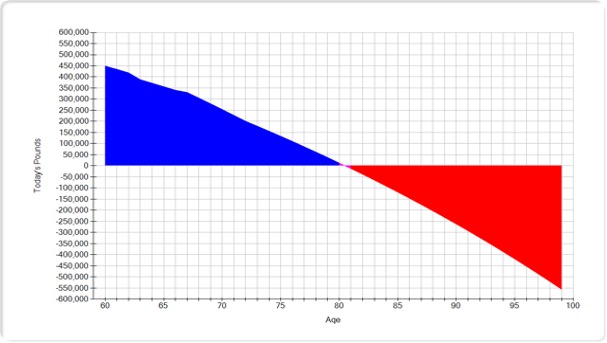

2. Not spending enough; being too frugal; not enjoying life to the full; paying unnecessary tax on death.

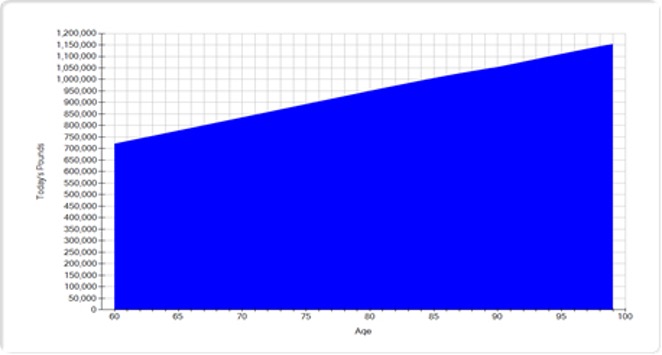

3. A great plan: spending what you want when you want to, keeping enough for care costs in old age and dying at the end of a happy and fulfilled life with no tax to pay.