“The Big Mistake”…

In late 1999, I met a new client who was about to sell his business and retire after 30 years hard work. He wanted some advice about his retirement and what to do with the sale proceeds. He already had some investments and wanted to know where it made the most sense to put the money.

Included in his portfolio was one of the now infamous technology funds and it was performing very well at the time. But most of his portfolio was invested in medium risk, balanced funds which had performed poorly in comparison to the technology fund.

Convinced that the rally would continue, (and specifically against my advice!) the businessman moved all of his balanced investments and the profits from selling his business into more technology funds. He made this move at the end of 1999. Anybody remember what happened to technology funds only a few months later in March of 2000? It was not good!

I recently heard that this man, who was all set to retire, is still working.

Many investors can afford little mistakes, like using a small portion of their savings to speculate on a particular stock because their brother-in-law knows someone who knows something. But the businessman, who otherwise had been very successful, made what we call “The Big Mistake.” For most investors, it is catastrophic and all but impossible to recover from.

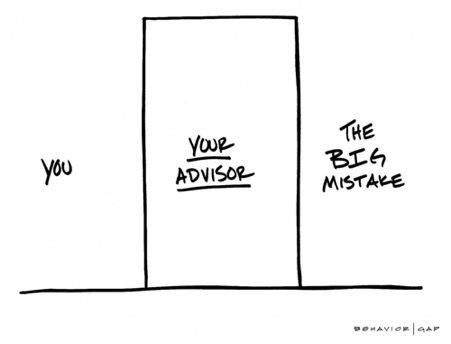

So, given the seriousness of The Big Mistake, we believe that one of our most important jobs is to prevent clients from making it in the first place.

We have seen many clients over the years heading down the path to their own “Big Mistake” Of course, we can’t force clients to not go down that path, but we use every ounce of persuasion to convince them otherwise and provide alternative strategies and better information.

DIY Investors can do things like fail to rebalance on time, own a mediocre investment, or be a bit tax inefficient. These are all mistakes people can survive and still reach their goals. However, it’s our calling as professionals to make sure we help our clients get the big stuff right. Much like a doctor’s Hippocratic oath to do no harm, the first thing we must do is to help our clients avoid The Big Mistake for their lifetime.

Clients may not realise it at first, but they need us to be a screening barrier between themselves and their financial decisions which are often made in times of high emotion and not always with all the necessary information. By talking things through we can help to match sensible decisions with goals and dreams to ensure the best way forward.

Otherwise, there will be plenty more people like the businessman, still working years after they thought they’d already be retired.

We must first and always be the thing between our clients and The Big Mistake.

Illustration by Carl Richards at https://behaviorgap.com/