At Magenta we help clients to build plans for their future security and happiness and this includes thinking about how to get back in the game when a relationship comes to an end.

Divorce is generally a stressful and unsettling event. A major relationship is ending, all sorts of routines are upset, and in the midst of the stress of transition there are legal hoops to jump through before things can be resolved. Add in the volatile emotions that are frequently associated with divorce and you have a difficult situation indeed.

We understand those common feelings of anger, grief and fear of the future and will work with you (and in some cases your spouse or partner too) to help you arrive at a fair financial settlement and then organise and simplify your financial affairs so you can move confidently forward into the next stage of your life.

We have personal experience in this unsettling and often unpleasant phase, but it is by no means unusual for relationships to end and we are seeing more and more clients in their later years, who have decided that life is too short to spend the rest of it with someone they don’t love anymore.

At Magenta we focus on the bigger picture and take into consideration the quality of life and happiness of our clients. It is often the case that as one door closes (even if it is slammed in fury!) another one opens onto a world of opportunity and potential.

The costs of separation and divorce can be very high if the process is not handled well – we can help to take away the financial sting and much of the stress, if we are consulted early in the discussions so that we can champion the needs of our clients and their families.

There may also be any number of extraordinary tasks that must be accomplished during the transition from married to single person (such as finding a new house, turning on utilities, changing insurance plans etc.) which add to the general mayhem. Creating a list and prioritising such necessary chores can help to reduce their stressful impact on your life.

We can help to manage your emotional and financial recovery during and after a separation.

Understand your future

When you are facing divorce or separation it’s vital to discuss your finances honestly and to think about what you want your future to look like. It’s important to understand what you need financially to move forward, ensuring both you and any children, will be secure in the long term. This can involve making hard decisions and having conversations that can be upsetting.

A personal lifetime cashflow forecast can help to determine what you need for the future, taking into account your current and future income and expenditure, assets and liabilities. Magenta specialises in divorce and separation issues, providing essential financial forecasts to help with mediation or court hearings.

How can a personalised lifetime cashflow forecast help?

Firstly, we can work with clients to help them determine what they require from any settlement in order to live comfortably and without financial worry. This is done BEFORE a settlement is agreed and may indeed form the basis for the structure of the settlement and the amounts and assets agreed.

Sometimes clients come to us only after reaching a settlement and so we can provide a cashflow projection based on what they now own and owe, as well as how they want to live in the future.

What is a lifetime cashflow forecast?

At Magenta, we work with clients so they can see what their future finances (and also therefore their life plans) will look like, by taking account of all current and future income and expenditure together with their current and future assets and liabilities.

The results can be shown in a simple picture like the ones below, as well as in a detailed quantitative analysis.

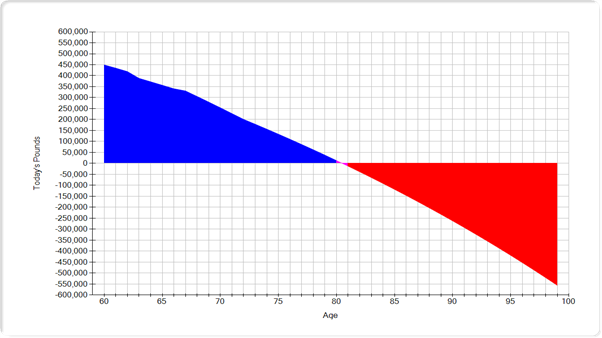

Cashflow 1

This shows that this client will run out of money – they will need guidance to improve their position perhaps by saving more and spending less or just by changing some of their expectations and assumptions of their future life.

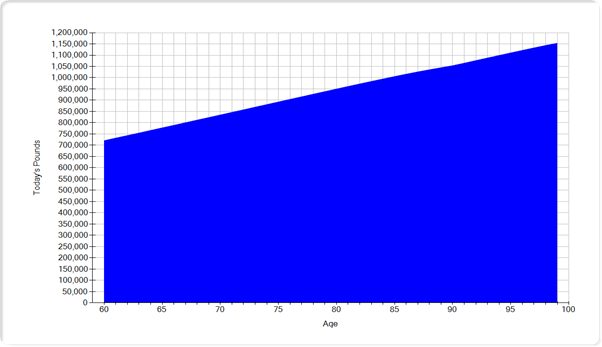

Cashflow 2

This shows that this client will never run out of money, but needs guidance on reducing inheritance tax and/or spending more money on things and people they love. Often clients like this need to be reassured that they can afford to spend their money during their lifetime, without worrying and their cashflow forecast is the perfect way to demonstrate this.

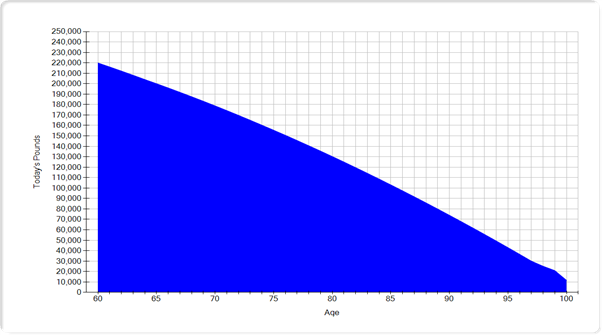

Cashflow 3

This is the perfect one where the client will run out of money at the same time as they run out of breath! In the meantime, they will have had an enjoyable, happy life doing everything they want to do.

For people who find themselves single again after possibly having the benefit of shared incomes and costs, financial separation in particular can be very stressful and worrying.

A personalised cashflow forecast can provide reassurance and/or highlight any changes that need to be made to ensure a client’s security and happiness.

Unless someone knows what they need to live on for the future and what resources are available to them, they will always feel insecure and face financial uncertainty throughout their lives.

Action points

Before moving forward with a cashflow forecast you should do the following:

- If you are concerned about your partner withdrawing money from a joint account, ask your bank to freeze it

- Check your credit rating and ask to be financially disassociated from your ex

- Make a list of your joint and individual assets and liabilities

- If you own property, get it valued

- Contact your mortgage, loan, pension and investment providers for balance statements

- Make a list of any insurance arrangements

- Make a new budget for the near future with revised income and outgoings

- Don’t forget to include any costs for children/dependents

- Consider what you want to do for the rest of your life and how much your plans will cost

When you are going through the process of splitting up and facing divorce it can be very easy to make rush decisions and jump into a financial agreement that may not be the best for you in the long term.

Magenta can help you avoid costly mistakes and make sense of the huge decisions you will be facing at this time, so give us a call for a confidential chat and see how we can help.