1. Get organised!

You can’t hope to make an accurate and robust plan for the future if you don’t know where you are starting from. Get all your paperwork together so you know what all your insurance policies cost, the cover levels and what they are for; what investments you hold and where and also make sure you can find full details of all your pensions (even for companies you may have left long ago!) Write a list!

2. What does your future look like?

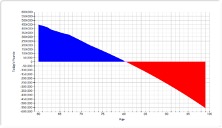

Get someone to help you put together a Lifetime Cashflow Forecast so you can see if your future looks like this where you don’t have enough money because you spend too much, or don’t have enough income, or are getting poor returns on your money:

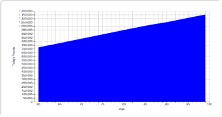

Or this, where you accumulate too much money in later life because you are not spending enough or giving money away to family. This means that you may not be doing things that you really enjoy because you are frightened of running out of money. It also means that you may have to pay a lot of tax when you die.

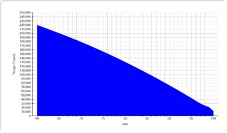

Or this where you have everything worked out so you can do whatever you want with your money to enjoy your life and to enhance that of your family, without ever worrying about running out or whether you have enough for nursing care.

3. Talk to your life partner and/or friends

a) About what you really want out of life. Share mental or actual pictures of your hopes and dreams and think about how you want to feel in the future – secure, happy, carefree, generous, spontaneous etc. This is what your money is for – it is not an end in itself.

b) Think about your relationship with money and why you behave the way you do perhaps because of some past experiences. Share this with the important people in your life so that you can understand each other better.

4. Write down your goals

They don’t have to be big and impressive – just things that will make you happy. Think of short term goals – things you want to do in the next 12 months; medium term goals in 1-5 years; longer term goals 5-10 years and very long term goals which depending on your age might be in retirement – how will you want to spend your time in what might be 30-40 years after you finish working. Written goals with timeframes attached are more likely to happen – otherwise they are just dreams.

5. What are the barriers to your success?

Think about what is stopping you from achieving the goals you have written down and the life you want to lead. Write down what you think the barriers might be. Then discuss these goals and barriers with someone you trust, to get a different perspective. Are they really barriers? For example, if you need more income, what is stopping you applying for a better job? Sometimes when you run at the barriers, they don’t seem so high.

6. What is your money story?

We have talked about limiting beliefs – money blockages or prejudices that stop us moving forward with the organisation of our money for a better life. In our experience, some people feel guilty to have more money than others and the idea of investing it for growth makes them very uncomfortable. Others find the responsibility of owning money to be too stressful and so they are caught like a rabbit in the headlights and do nothing with it to improve their life or those of the people dear to them. Other limiting beliefs can include: investing is only for rich people; talking about money is vulgar. But these are just beliefs that you have picked up based on your or someone else’s experience – they are NOT facts and if they are holding you back we can help to put them into perspective.

7. Educate yourself about risk

One of the biggest limiting beliefs is that investing in the stockmarket is very risky and therefore very scary. But we take risks everyday – in fact just breathing in at the moment is a risk! It is the understanding and management of risk that is important. If you are clear about the upsides and downsides of risk, you can make a judgement about whether it is worth taking for your personal circumstances. It would be a shame to risk a comfortable, secure and happy future, just because today you are unclear about investment risk. What is the biggest risk – that your money will fluctuate in value, or that you will never achieve your life goals?

8. Pay yourself first

Make sure that you set money aside each month into an emergency fund, a fun fund, a long term accessible investment and a pension BEFORE going on to your usual spending. Only saving what is left over at the end of the month is rarely a successful strategy for a better future. Those people who deduct money automatically at the start of the month are likely to have more money in the long term.

9. Tidy loose ends

Make sure that if something goes wrong, you are prepared. Eg: if someone dies or has a serious illness there are some pretty dire financial consequences. So make sure you have a plan B to replace income or provide a capital lump sum to help weather the storm. Make sure you have written your Wills so that you are clear who will inherit your assets when you die and also write Lasting Powers of Attorney in case you become incapable of looking after your own financial affairs and health.

10. Review and revise

Make sure that you look at your financial situation and measure your progress towards your goals at least once a year. Like a sailing boat that constantly needs to change course because of high winds, you too might be blown off course by life events and need to make some changes as you go along. Keeping on top of your finances will ensure you stay in control and feel confident about your future life prospects.