Remember Mystic Meg and her crystal ball? She could look into the future and tell you what was going to happen!

At Magenta we don’t have a crystal ball or any supernatural gifts, but we can definitely tell you what your financial future will look like if you make certain decisions or whether you take no action at all.

At Magenta we take time to work with you and to find out what you consider to be the most important and valuable things about your life – both now and in the future.

Then we create a personalised cashflow model to forecast your future finances and help you understand what your future life could look like and whether it is what you want.

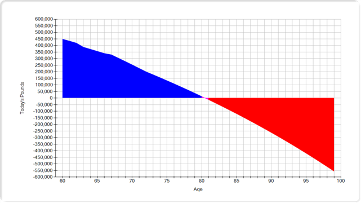

Cashflow modelling takes into account your individual circumstances – the money you currently have and expect to have, your future income and desired expenditure – and creates an easy to understand, visual illustration for you.

Something like this! This person, needs to earn more money, spend less, make their money work harder or a combination of all these, to avoid running out of funds in later life.

What might your cashflow forecast look like?

We can also consider various “what if” scenarios to help you understand the impact of different decisions.

Your cashflow model will help you answer some of the big life questions such as:

- Do I have enough money?

- When can I afford to retire?

- Can I give money to the children?

- Will my family have enough if I am not around?

It will help you to understand the growth you need on your money, the maximum amount of risk you need to take and how much you can afford to lose without affecting your lifestyle.

Client case study

Malcolm and Elaine came to see us a few years ago when Malcolm was 58 and working as a solicitor in a busy city practice. Elaine was a teacher but hadn’t been working for a while as she had cancer.

Their primary reason for coming to see us was to clarify what Elaine’s various pensions would pay out as a result of her ill-health.

Once we had asked them about their hopes and concerns for the future and got some specific financial information, we produced a personalised cashflow and discussed it with them in detail.

We were able to show them that their combined pensions and other savings, together with downsizing their large house to release further funds when Malcolm reached 75, would be more than sufficient for the comfortable retirement they envisaged.

Furthermore, we were able to show that Malcolm could retire immediately rather than wait to 65 as he had planned.

They were surprised and delighted with this news and set the wheels in motion a few weeks later.

Sadly, they only had another 3 years before Elaine passed away, but they spent this time together and Malcolm likes to tell us that we made it possible for them to enjoy these last precious moments and that had we not provided the planning information and reassurance, he would have continued working and regretted it for ever.