At Magenta we know one thing for certain – that life doesn’t follow a linear path and that change, whether for good or bad, is always around the corner.

Life is full of changes and events – some will bring joy and others sorrow. Our experience encompasses all possible changes and we recognise that even small life events can have a huge impact on our finances and our ability to save and plan for a secure and happy future.

Failure to identify and readjust financial planning strategies when appropriate can have far-reaching impacts, resulting in challenging and often unfavourable financial outcomes.

Often big life changes act as a catalyst for people to seek financial planning advice and it is really important that this happens as soon as possible when redundancy is a possibility.

We know that people go through a range of emotions as they try to come to terms with being out of work, but with some careful planning, what might initially seem very worrying, can often signal new opportunities. A career break or complete switch; early retirement, setting up a new business, and retraining in a different field are all possible routes to greater fulfillment in the future.

In past years, people in a steady job often felt more secure than those who worked for themselves, but with improvements in technology, automation, and communication, this is no longer the case.

Coronavirus has shown many employers that they can operate in different ways if they embrace the digital world, which may mean that they can afford to employ fewer people.

Broadly there are 2 types of redundancy:

Voluntary – where an employer wants to reduce its workforce and wants to offer terms to valued employees to leave with some money to give them time to find other work or to maybe retire sooner.

Involuntary – where an employer usually has to make some difficult decisions to reduce its workforce or possibly go out of business.

Understand your future

Whether you are thinking about taking a redundancy offer, or have been told you have to leave, it’s vital to think about your finances and what you want your future to look like. It’s important to understand what you need financially to move forward, ensuring both you and your family will be secure in the long term. This can involve making some hard decisions and significant reductions in lifestyle in some cases.

A personal lifetime cashflow forecast can help to determine what you need for the future, taking into account your current and future income and expenditure, assets and liabilities. Magenta specialises in life-changing events, providing essential financial forecasts to help with decisions that will affect future security and happiness.

How can a personalised lifetime cashflow forecast help?

Firstly, we can work with clients to help them determine what they require from any redundancy offer in order to live comfortably and without financial worry. This is done BEFORE a decision is made to ensure that the money being offered to leave work will be sufficient.

Sometimes clients come to us only after being made redundant. We can then provide a cashflow projection based on what they now own and owe, as well as how they want to live in the future.

What is a lifetime cashflow forecast?

At Magenta, we work with clients so they can see what their future finances (and also therefore their life plans) will look like, by taking account of all current and future income and expenditure together with their current and future assets and liabilities.

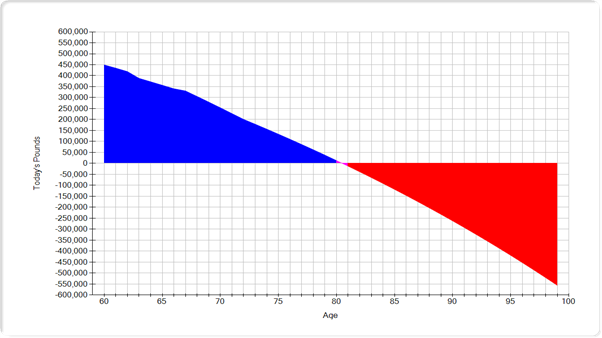

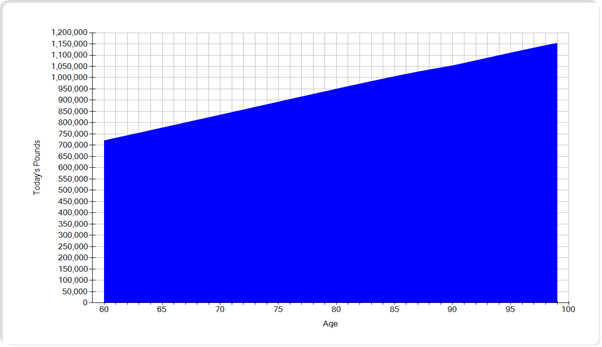

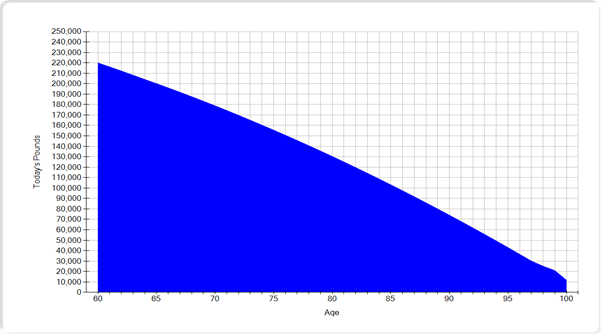

The results can be shown in a simple picture like the ones below, as well as in a detailed quantitative analysis.

Cashflow 1

This shows that this client will run out of money – they will need guidance to improve their position perhaps by saving more and spending less or just by changing some of their expectations and assumptions of their future life.

Cashflow 2

This shows that this client will never run out of money, but needs guidance on reducing inheritance tax and/or spending more money on things and people they love. Often clients like this need to be reassured that they can afford to spend their money during their lifetime, without worrying and their cashflow forecast is the perfect way to demonstrate this.

Cashflow 3

This is the perfect one where the client will run out of money at the same time as they run out of breath! In the meantime, they will have had an enjoyable, happy life doing everything they want to do.

Life can be very stressful and worrying for people who find themselves suddenly out of work and even those lucky enough to choose to leave will want to know that they have enough money to fund their desired lifestyle.

A personalised cash flow forecast can provide reassurance and/or highlight any changes that need to be made to ensure a client’s security and happiness.

Unless someone knows what they need to live on for the future and what resources are available to them, they will always feel insecure and face financial uncertainty throughout their lives.

Action Points

Once redundancy is on the horizon and before moving forward with a cashflow forecast you should do the following:

- If appropriate, sit down with your life partner and family and make some decisions about how you want to live the rest of your life. (Think about the bigger picture and focus in from there – eg: if you have really always wanted to be a vicar, or pilot, or teacher, start with that in mind and then work out how to get there.) How much will your new plans cost? You will be surprised how much a good financial planner can help with this!

- If required, start looking for a new job.

- Seek medical help if you feel stressed or overwhelmed – this is a BIG life change.

- Think about your spending – define what is essential spending and what is “nice to have” and adjust this if necessary to reflect the new situation.

- Make a list of your joint and individual assets and liabilities

- Get an up to date pension statement from your employer and details of your options

- If you own property, or other valued assets get them valued, just in case they are needed

- Contact your mortgage and loan providers and let them know the situation if repayments might be a problem

- If you think you may have problems paying bills, speak to your creditors as soon as possible

- Make a list of any insurance arrangements provided by your employer – life cover, critical illness cover, income protection, private medical insurance etc and consider the costs of replacing these if affordable.

- Make a new budget for the near future with revised income and outgoings

- Read your redundancy paperwork in detail. If you do anything to compromise the agreement, (such as starting a new job too soon) this could be a problem. Seek legal advice if you are uncertain.

- If you have a lump sum from the redundancy, that you are unlikely to need in the near future, take advice about investing this properly.

Click here for more information about your redundancy rights and here for some inspiration for the future.

When you are going through the emotions of losing your job, it can be very easy to make poor financial decisions that may not be the best for you in the long term.

Magenta can help you avoid costly mistakes and make sense of the huge decisions you will be facing at this time, so give us a call for a confidential chat and see how we can help.