Most people would agree that a ‘good retirement income’ is one that offers them security, that allows them to participate in the activities they want to do and provides them with a comfortable enough standard of living to be happy.

Research by the National Employer’s Savings Trust (Nest) in 2014 stated that £15,000 was the income level where retirees begin to feel comfortable and more secure. Adjusted for inflation that’s about £16,350 in today’s money.

The 2014 report stated that reported levels of well-being rise significantly once retirees earn between £15,000 and £20,000 but there is no happiness benefit above £40,000 a year.

Royal London put their ‘comfortable’ retirement income at £17,500 a year. With the current UK state pension providing just over £8,500 a year, according to this, the average person retiring at state pension age will need to add over £9,000 a year to top up their state pension to a comfortable income level.

Individual circumstances

But of course, the above figures are always based on averages and at Magenta we know that not all of our clients are “average!” This is why we place so much emphasis on personalised lifetime cashflow forecasts to help clients determine what is an appropriate and acceptable amount of retirement income that allows them to pursue their passions and feel secure and happy.

But calculating the amount of income required is only half of the story, the next important part is how to take the income – i.e. where have you accumulated your retirement fund, what is the most tax effective way of withdrawing it, when should it be withdrawn and in which order should you use it?

This is often where people go wrong – particularly if they have not taken specialist advice. Pensions legislation is very complex and we know of many people who come to us AFTER making irreversible decisions about their retirement income, who could have achieved better outcomes, both in terms of the amount of income and the amount of tax payable.

It’s not all about pensions!

So many people think that when we talk about retirement, we are talking about pensions. But in reality we can all fund our retirements from a combination of different sources, some of which will be more efficient than others.

Instead of thinking about “income” (which is after all just money that usually has to be declared for tax,) lets talk about money in your pocket for spending.

Let’s look at where this money for spending might come from, specifically once you have retired.

In no particular order some sources are:

• Cash in the bank/building society/under the mattress!

• Part time/consultancy work

• ISAs

• Pensions – personal and/or occupational (possibly from many different sources)

• State pension

• Property rental income

• Share/portfolio dividends

• Sale of assets/investments

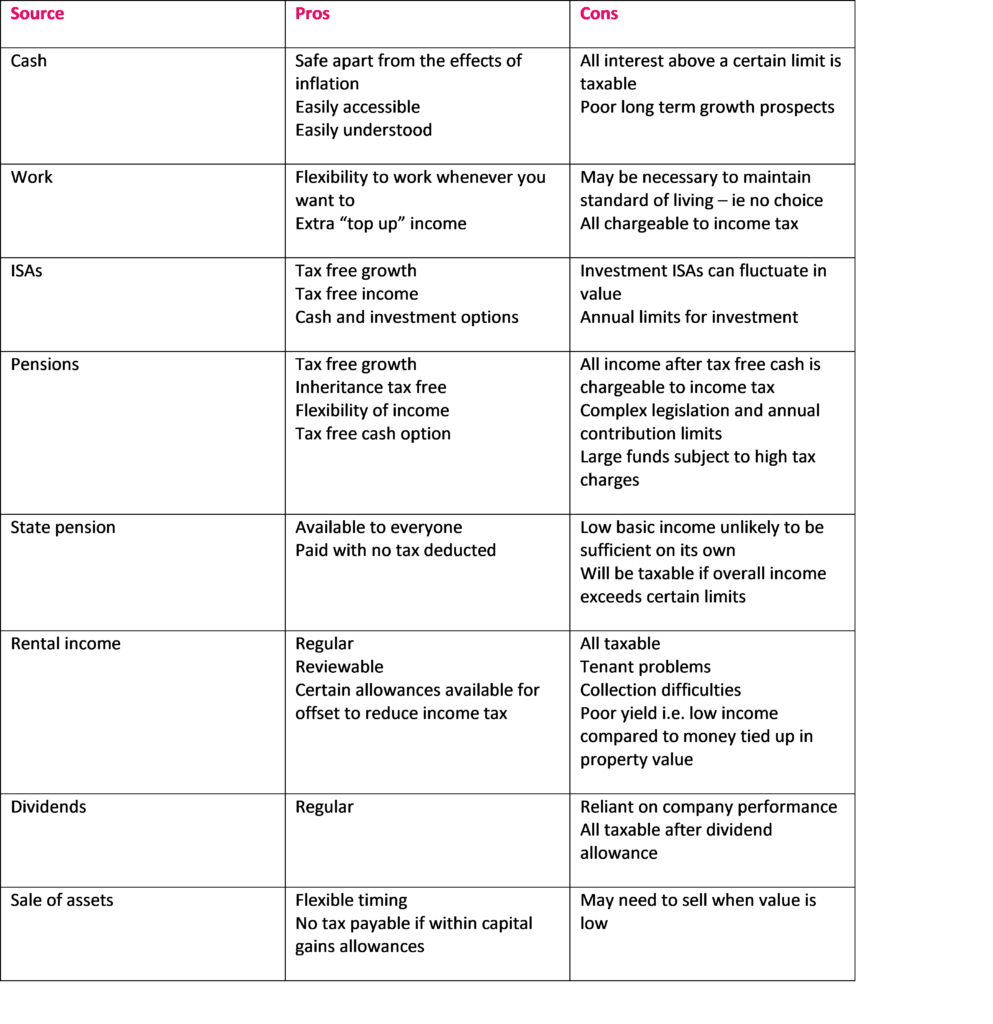

Now let’s look at the pros and cons of taking your money for spending from each of these:

When assessing how any particular client should make up their retirement spending money, it is important to take into account the client’s future spending plans – big holidays; golden wedding parties; helping grandchildren through university etc – as well as their day-to-day living requirements. Regular updates to cashflow forecasts will help with this as well as concentration on the tax efficiency of any income strategy.

The following chart shows a simplified strategy for managing spending money and broadly assumes that enough cash is set aside for at least 2/3 years regular expenditure plus enough to cover large costs during this time.

The rest of a client’s money is then invested to provide returns greater than cash interest rates – although this cannot be guaranteed of course! Some of the money will be in lower risk, fixed interest investments and this will be called upon every year to top up the cash reserves. At the same time, money from the higher risk/greater return investments will replenish the fixed-interest element when we rebalance the client’s portfolio every year.

Thus, the client will always have the money they need to spend at the right time, while allowing the rest of their money to grow in the longer term.

Investment hierarchy

As stated above, once the necessary amount of cash has been determined, everything else can stay invested, but how do we then decide how to release funds for spending from those investments to replenish the cash?

One part of the strategy is clear – if clients have sufficient funds outside their pensions and they have an estate that will incur inheritance tax, they should probably drawdown money from their pensions last. This is because money can be passed to the next generation inheritance tax free if it is in a pension fund, so it makes sense to spend the non-pension money first.

However, for most clients, their retirement spending money will be made up from various different sources depending on their requirements, tax position and age.

For example, a couple with a sizeable portfolio could sell say £12,000 of assets each, without paying any capital gains tax. They could also take money from their ISAs tax free (say another £3,000 each) plus say £6,000 each from their cash, which together with their state pensions (at least £8,500 each) gives them a total income of £29,500 each this year.

Next year, these figures and the sources of funds can be changed to suit their circumstances at the time – it might be preferable to take some tax free cash from their pensions, or to reduce their cash spending – all possibilities will be explored and explained so that clients can use their money efficiently for what makes them truly happy.

If you are uncertain how to effectively fund your retirement years, do call us for a friendly chat to ensure you maximise your income, minimise you tax and don’t make any costly mistakes