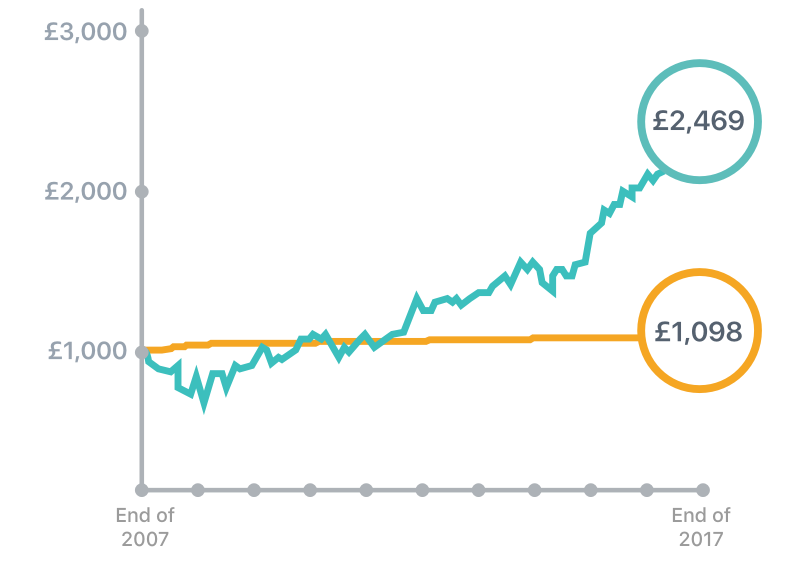

We’ve written about this many times before, however, the events around the Brexit deal and the market volatility we have seen of the first few weeks of 2019 has prompted us to want to reiterate the importance sticking with your investments and that time in the market will pay off.

You only need to listen to or read the news to worry about your investments and we’ve had several people ask whether a move to cash is a good move. In the context of long term returns, there is a simple answer to that – it isn’t.

Looking back at the worst market conditions in recent memory, Seven Investment Management (7IM) illustrated the following for us:

A 7IM Balanced holding worth £100k on 19th May 2008, the day the FTSE began its descent that year, is now worth around £156k. However, with a year spent in cash from 1st March 2009, the market low, it would be worth only £126k today. That’s a whopping 56% vs 26% return.

Those dates were the worst you could have picked, however if you’d had a crystal ball and timed your exit from the market perfectly and avoided more downside, i.e. cashing out on 1st October 2008 for one year, you would have experienced a 43% return vs 56% had you stayed invested.

Almost every scenario 7IM has run ends in a lower return when investments were substituted for cash around the financial crisis. Only if you’d timed it perfectly, into cash at the top and back in at the bottom, did it work – and the brightest minds in the investment profession didn’t managed to call that. Click here to see the two examples mentioned.

The figures speak for themselves, that it’s time in the market, not timing the market that pays.

We’re always happy to have a friendly chat if you have any specific concerns about your financial planning.

Graph shows 10 year return of FTSE All World index (blue) vs. cash at Bank of England base rate (orange), 2007 – 2017. Source: Moneybox