I am Louisiana Salge, Senior Sustainability Specialist at EQ Investors. I joined the investment sector from a background in sustainabiliy because I deeply believe that the finance sector can be an important lever for sustainable change.

Investing should not just benefit you via the financial returns you receive, but also benefit people & planet around you.

I now work at EQ Investors, where sustainable investing is at the core of our capabilities, and make sure that our portfolios are aligned to create positive impacts on the various UN Sustainable Development Goals.

Today, in light of the global climate crisis, I want to share how global warming can impact our economies and how your investments can be positively aligned to the green transition we desire, while avoiding the risks of investing without a sustainable lens.

The climate change challenge

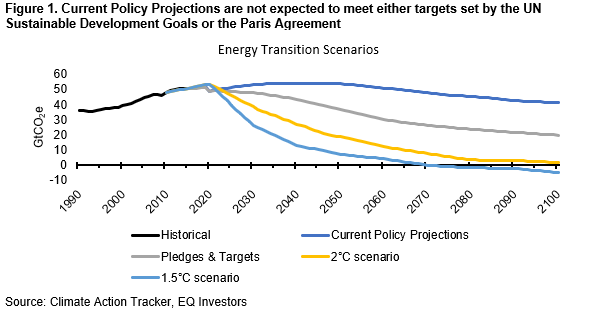

The world is not on track to meet either energy-related components of the UN Sustainable Development Goals or the targets set out in the 2015 Paris Agreement. And yet, the effect of climate change will affect every country on every continent, disrupting economies and posing major risks to capital markets.

To prevent an irreversible change to the planet, the world needs to reduce the almost 50 billion tonnes of greenhouse gas emissions each year (as measured in carbon dioxide equivalents, CO2e) – with an end goal of reaching net-zero around 2050.

The strongest reduction will need to happen in the next decade, as climate change impacts are related to cumulative emissions – so the longer we wait for drastic action, the harder it will be to limit global warming to our 1.5-degree target.

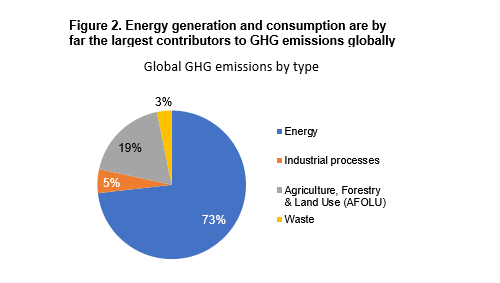

Though data shows the greatest concentration of climate change-related emissions is from “Energy” (Figure 2), we recognise it to be a broad category that spans from generation to consumption. We understand the opportunity set for decarbonisation to centre around five key areas: Power Generation, Transport, Industry, Buildings and Agriculture.

Where Global Investment is going?

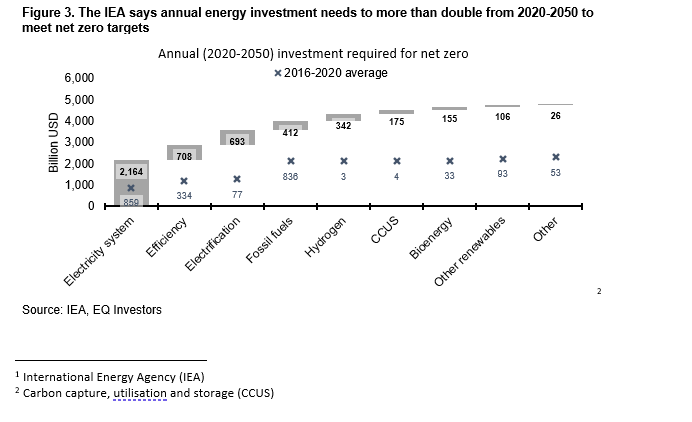

The IEA’s[1] Net Zero by 2050 paper asserts that annual investment in energy needs to rise from just over $2 trillion globally to almost $5 trillion in order to achieve carbon neutrality. The dominant focus of investment is expected to be on electricity systems such as generation, storage, and distribution, and public EV charging points for larger scale use (Figure 3).

Invest to align with the green transition

Climate change poses significant potential risks to investments as regulation, consumer pressure and innovation re-arrange our global economy and create winners and losers of the transition. High polluters are likely to suffer from rising cost of carbon, and the high cost of shifting business models in line with new sustainability standards and market demands. Avoiding these investment risks is important, but investments can also positively align with decarbonisation solution providers.

Below we explore investable solutions from the EQ portfolios in electrification and battery storage.

Investing in grid infrastructure: Moving away from fossil-fuelled, point-source, energy generation towards the electrification of transport, buildings and industry means electricity demand will increase. Utilities such as Iberdrola’s Scottish Power are investing to make grid infrastructure robust enough to deal with increased electricity loads, and Smart Metering Systems is providing smart technology to improve the efficiency of electricity flows.

Greening the grids: To provide a green solution, increasing our economy’s reliance on electricity means we need to shift its generation to renewable sources. Companies like Siemens Gamesa provide wind turbine technologies, and investing through green bonds helps scale up finance to build out more renewable energy capacity. Examples from our portfolios include green bonds from across the world: India via ReNew Power, and Germany’s green federal bund. The UK has announced the issuance of green bonds in the near future too.

Battery storage: Renewable electricity generation is often more intermittent than fossil fuel generation, and therefore its effective inverting and storage is fundamental to green electrification. Utility scale battery storage will be needed to feed green electricity to the grids, and companies like Samsung SDI are developing best in class batteries of this scale, while Schneider Electric are providing the inverters for small and large scale solar.

Electric mobility: The electrification of transport will eliminate the tailpipe emissions from personal transport. Tesla is a leading personal electric vehicle manufacturer, and WEG is providing electrical motors for use in heavy duty vehicles and public buses. Both companies realise the need for charging infrastructure, and are branching out their business model to provide charging points.

Conclusion

I hope that this blog has shown you how the EQ Portfolios intentionally invest in solution providers to the green energy transition challenge, and avoid the risks that can be associated with lagging behind this transition.

The upcoming COP26 talks in Glasgow will most likely accelerate the demand for sustainable investment solutions, and result in a more supportive regulatory and public spending environment for green technologies – including those described in this blog. Reflecting on our 8 years of sustainable investing experience, we believe this to be a critical point in time.

We are excited to be able to provide portfolio solutions that invest in a growing number of solution providing businesses, which create positive impacts on the climate crisis but also simultaneously will financially benefit from the performance tailwinds associated with a global move to net-zero.

By investing in businesses that create positive impacts, the you can additionally benefit from financial performance tailwinds in regulation, market demands and consumer pressure associated with a global move to net-zero.

With thanks to Louisiana and EQ Investors for their thoughts and input for this Blog.

A note from Magenta:

We’ve recently written a new guide – Magenta’s Green Money Guide – which focuses on the different options, details about the UN sustainable goals, things you may need to consider and also some journaling questions around your thoughts, beliefs and values. You can download this guide by clicking this link.

We’re also running an online webinar on this topic – providing information about the options, benefits, risks and practical steps of investing in this way. If you’d like to register for this, please complete the registration form here.

If you know someone who would be interested in this guide or webinar, please forward this email on to them.