How many times have we heard this? Often potential new clients or people we meet socially, cite this as a reason for keeping their money in cash and not investing properly for the future.

Equally, some newer clients may call and ask for their portfolio to be moved into cash because they are expecting a market crash. Our job is to show them that this is not a good idea and also to provide reassurance that everything will be all right.

Hardly a day goes by without popular press mention of stock markets around the world reaching all-time highs – the implication being that we should all expect bad news soon.

It’s not surprising, therefore, that some people are concerned about committing money to investments and are considering waiting for a “better time.” But is it sensible to hold off?

Why should we invest?

First, it’s important to remember why we are investing. Investing should be about helping us achieve what we want in life, be it a comfortable retirement or another, more tangible, goal over the long term. Investing in shares can help with that. The equity market in the United Kingdom has averaged a return of 5% after inflation since 1900, but it is never a smooth run. Returns come in fits and starts. That’s what investing is about – accepting the short-term risk for the potential of longer-term benefit.

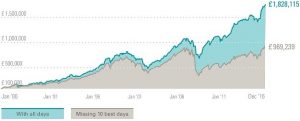

If we look at the data more closely, it’s surprising how quickly stock market returns can be generated. In the graph below, the blue line shows the return of the FTSE All-Share Index since January 1986. The grey line shows how this return would be eroded if you missed the ten best days over that period. Trying to time the market could cost us half our return. This is why it’s often said that time in the market is more important than timing the market.

The impact of missing the best 10 days of the FTSE All-Share Index, 1986–2016

Note: Past performance is not a reliable indicator of future results.

Source: Vanguard FactSet as at 31 December 2016.

Can we predict a crash?

We know that the future is full of unpredictable and random events and it is impossible to foresee what will happen to anything including investments. It is simply not possible to predict accurately whether a crash will or will not happen, although there are plenty of people who try to tell us otherwise!

Investments in stocks and shares (equities) have performed very well over the long term and there is no reason to suspect that this will not continue as long as companies exist to make profits and share these with their shareholders. After all, we all need to eat, put fuel in our cars and heat our homes, so the companies that provide food and fuel will always have a market to trade in.

People who invest have long been rewarded for taking risks with their money while people who stay in cash will continue to lose the value of their money if inflation is a higher number than interest rates.

Is it possible to plan ahead for market crashes?

We know that crashes or market corrections, will happen at some point in the future, but we can’t know when. The secret is to ensure that clients will not feel the effect of a crash when it happens by ensuring they have enough liquid funds to weather the storm until their portfolio inevitably recovers. If clients need to withdraw money from their portfolio when the value is down as a result of a crash, this is not good. So it is important that we know their future spending plans so we can build a robust investment strategy.

When we build financial plans for people, we stress test various scenarios by including crashes. If we can prove to people that, even in the event of a crash, their financial plan is sound and their standard of living will not be affected, then this is very reassuring to them and gives them greater confidence. We can also show them how much risk they can afford to take with their investments, or whether they need to take any at all.

Modelling the effect that a crash would have on a client’s finances is an important part of good financial planning.

So how can we increase our chances of investment success?

If returns are likely to be lower this means we need to invest more to reach our goals – sorry, there is no free lunch!

Sticking to the following rules should certainly help though:

- Start investing sooner to benefit from the effects of compounding over time

- Use valuable tax allowances such as ISAs and pensions because, all other things being equal, reducing the impact of tax will improve our returns

- Review and increase the amount we save annually

- Keep costs low – costs are one of the few things we can control

- Stay disciplined and stay invested – remember the impact of missing just a few of the best days.

If we are investing for 10, 20 or even 50 years we know with certainty there will be bad years. However, time and time again, investing rewards patient long-term holders who stick to their plan.

Remember, it’s time in the markets, not timing the market that counts.

If you would like more information about the above, please feel free to call us for a friendly chat.