traditional, ethical, ESG and positive impact investing explained in simple terms.

At Magenta we are keen to give clients the opportunity to invest in a way that makes them feel comfortable, secure and confident that they are using their money not only to benefit themselves and their family, but also for the greater good of society and our planet.

But it is becoming ever more confusing and difficult to distinguish between the various different types of investment. Hopefully this blog will help to make things clearer and provide readers with information about investments they may not have heard about before.

The Great British Sustainable Savers Census by Boring Money, has found that the outlook of investors can be split into 6 “tribes” ranging on a spectrum from Eco Warriors – “environment first, financial gain second” – to the Pure Returns –“I invest to make money and don’t really care about anything else.”

The most common UK tribe is called the “Moderate Greens” – over 14 million British savers and investors fall into this camp. They invest primarily for returns, but do care about the environment in a secondary way. For example, in their personal lives, recycling, cutting down on food waste and shopping locally are their three main ways of helping with sustainability.

We know from speaking to our clients, that everyone would like to play their part in helping to make the world a better place, however small their contribution. Never has this been more so than at the moment when we are dealing with a pandemic. Covid has made a difference – many people have been soul searching as they have had time to think about the future and the bigger picture of their lives, their purpose and motivation. It follows then that many are more receptive to different investment ideas that gel more with their own thinking.

We understand that only half of all financial advisers talk to their clients about investing for good outcomes and consequently traditional investments are still in the majority – however this is changing as people realise they have other options.

It makes perfect financial sense to invest in “good outcome” funds, evidence shows that returns are as good or better than traditional investments and in theory at least, “good” business should create good business. At Magenta we believe that companies that concentrate on doing the right things will thrive and in the future, investors will be able to rely on these being the norm rather than the exception.

But it is complicated, as fund managers have realised that if they market their funds as “sustainable” or “ethical” they will sell more. It’s the investment equivalent of the word ‘Artisan’ in the food industry and should be treated with caution.

Our due diligence ensures that the companies we deal with, do what they say they will – and we have no hesitation in advising clients to move money if their investments no longer chime with their personal beliefs and what is important to them.

Definitions

Traditional Investment

Where money is invested into companies based on the expectation of profit and good income from dividends. All companies are considered irrespective of business sector and money maybe actively managed or invested into index tracking funds. Their investment remit is unrestrained or filtered, other than by risk parameters and asset allocation.

Ethical investment

Where money is invested, usually in managed funds, which focus first and foremost on exclusions, ie screening out companies whose activities are considered harmful to society and the environment. This exclusion usually focuses on so-called “sin stocks” such as tobacco, gambling, weapons and adult entertainment. Other issues screened might include animal testing, intensive farming, nuclear power, genetic engineering, deforestation, and poor human or labour rights. Some people are very keen NOT to invest in certain areas and this is a good approach for them as it screens out controversial sectors.

Environmental, Social and Governance (ESG)

ESG is a framework used by money managers to integrate non-financial information into their decision making process as this additional information can have a meaningful impact on share price performance. ESG investment primarily focuses on companies’ operational practices, ie how the business is run. ESG investing will then look to favour those companies that are better than their peers in terms of their operational footprint. Whilst there are many ways of doing it, often ESG investing means investing across all sectors irrespective of the impact that the companies’ core products and services can have on society and the environment. Investors who are keen to see companies behave well eg: don’t pollute rivers and care for staff etc, will be attracted to this approach.

Positive Impact investing

This type of investing takes an active approach to generating positive impact by investing in companies whose products and services actually make a positive impact on society, education, diversity, the environment etc rather than just negative impact avoidance. Impact investing also adds another element: the ability to measure the effect of the investment. Money is invested and actively managed in companies, organisations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return. For those looking to make the world a better place, but not wanting to sacrifice returns or profits, positive impact investing aims to support positive social and environmental issues at the same time as providing good financial returns and an emotional feel good factor for individual investors.

It can be said that ESG investing is about doing things right whereas positive impact investing is about doing the right thing.

“ESG is what keeps you up at night, impact is what gets you out of bed in the morning” (former PRI CEO James Gifford)

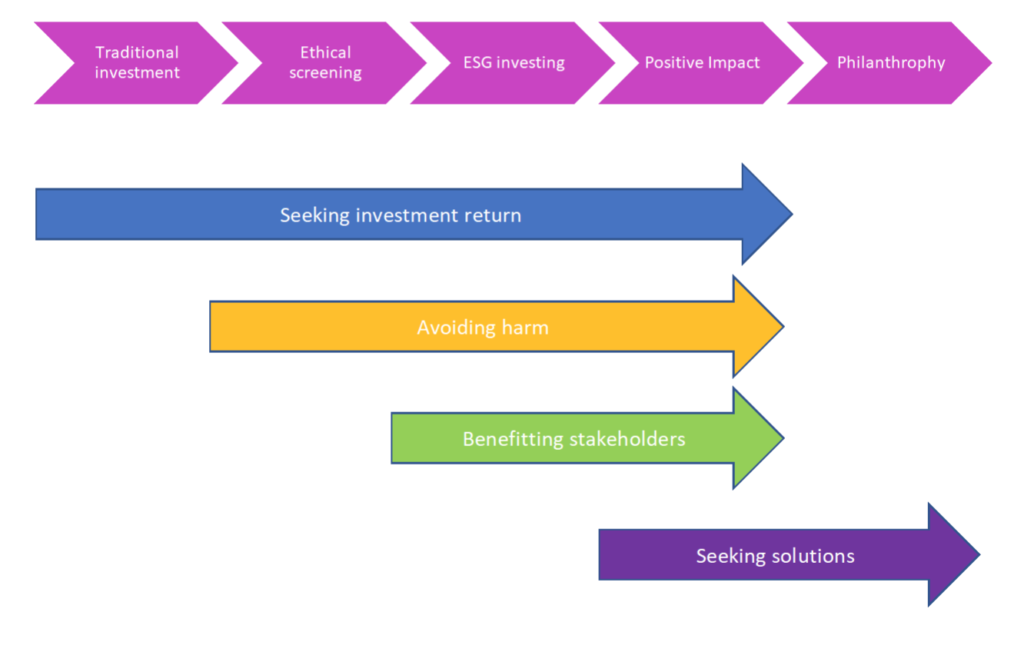

The following chart is a simple visual way to differentiate the different investment approaches:

All investment options are important and we will work with clients to ensure they use their money to reach their goals while also satisfying their personal values. However, we really like the concept of Positive Impact Investing as it provides the opportunity to make investments that not only deliver good financial returns, but also have the potential to generate positive outcomes that address some of the most imperative challenges that we face as a society, such as climate change and poverty.

Magenta Financial Planning Limited is authorised and regulated by the Financial Conduct Authority. This information is not investment advice.